The financial world is changing, and many financial experts believe in the next five to ten years that the United States will lose the world currency (the dollar) and go to a digital platform for exchange of goods.

This can be accomplished by a digital blockchain that is either decentralized or centralized. The term decentralized finance (DeFi) is a secure distributing ledger or an ecosystem where customers can access financial products and eliminate banking fees that standard financial institutions charge and the participants of the block chain will be able to move money more securely around the world without government intervention.

I am going to provide a simple explanation on how crypto platforms and DeFi works and give you my opinion in the last paragraph of this article on why digital currency maybe the next financial currency and how to benefit from its uniqueness.

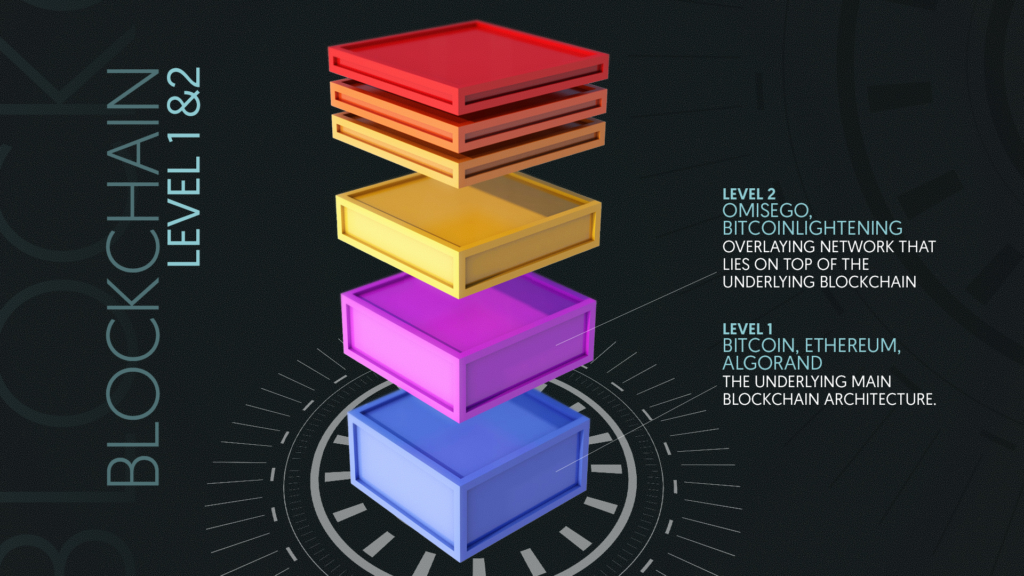

There are many layers of a blockchains, however, the main two layers are level one and level two. The first level is called layer one which is the blockchain-based foundation where developers can build upon the original blockchain. The level one block-chain is designed to make improvements to the base protocol and make the overall system a lot more scalable. The most popular layer one base block chain is Ethereum.

Layer two platforms are projects that are designed to be built on top of layer one to increase speed, decrease costs and help scale projects to perform easier and smoother transactions. Some layer two platforms are Polygon, Arbitrum, and Optimism.

There are also platforms where there is only one purpose for that block-chain. For example, Bitcoin is a single purpose block-chain where the originator designed the platform to only exchange digital currency and nothing else, between merchants, without government intervention. The beauty of Bitcoin is that the platform is decentralized and again the government cannot get involved with the transactions and the currency can be moved around the world.

However, there are already some crypto platforms that do have some centralization in their platform. One example is Solana. So, I believe that we will be moving one day to a decentralized exchange, however, with some centralization added to the block-chain.

Other layer two platforms that establish digital goods outside of currency are also called NFT’s.

NFT’s are a non-fungible token which is a one-of-a-kind digital asset that belongs to you and you only. Some examples are photos, art, trading cards, videos, etc. The most common marketplaces for NFT’s are OpenSea, Mintable, Niffy, Gateway, and Rariable. However, these platforms are having problems with scammers, theft, and wash trading. Wash trading is a process whereby a trader buys and sells a security for the express purpose of feeding misleading information to the market. In some situations, wash trades are executed by a trader and a broker who are colluding with each other, and other times wash trades are executed by investors acting as both the buyer and the seller of the security. Wash trading is illegal under U.S. law, and the IRS bars taxpayers from deducting losses that result from wash trades from their taxable income. 1,2 That being said, the auction house Christie’s is using this digital blockchain to secure payment for their clients. One of the most recent sales from Christie was an image of a digital artist Beeple for 69.3 million dollars. NFT’s are a new trend for investors creating wealth through collectibles.

Metaverse is a new layer of NFT’s on the level two platforms. Metaverse is a digital virtual platform where the users feel that they are experiencing a real-world effect through a virtual world. Gaming is a great example of this. The users feel that they are in the game, as one of the players.

Over time this block-chain technology is going to play a key role in providing a different financial utility to the world stage. In the future, block-chains may determine how we purchase items, record items, buy items, exchange financial transactions, and many other situations.

Below is an illustration of a level one and level two blockchain.

Source: cryptonewslist.com

Crypto currency can be a very risky trade if you are an investor as a crypto trader, as a trader, in today’s crypto currencies or platforms there seems to be many fluctuations with severe swings, which can either deliver an investor with a win or a good chance to lose a lot of money.

Personally, for me, I believe due to our debt (30 trillion) that the United States has a strong chance of losing the world currency in the next five or ten years. I also believe our government will be moving towards, if not already doing so, creating a digital currency that will not be decentralizes, but centralized. Meaning that the government will control all value of exchanges, apply taxes, and control how much and where you spend your wealth. So, in a way, I am rooting for Bitcoin so that the U.S. citizens will have a way to exchange wealth safely and freely.

Some financial advisors like crypto and some do not. Just recently the SEC has added Coinbase (Coin) to the stock exchange as an ETF. I have tried this exchange since January 2022 and had problems. I would not recommend Coinbase.

I believe over the next few years that crypto currency/blockchains will continue to grow and revolutionize the markets. However, keep in mind that trading crypto is extremely risky due to the possibility that the government might step in to regulate the process moving forward. Good luck on which way you decide to get involved in this new, exciting, and revolutionary technology.

- Internal Revenue Service. “Publication 550: Investment Income and Expenses,” Page 56. Accessed April 6, 2021.

- Commodity Futures Trading Commission. “CFTC Glossary.” Accessed April 6, 2021.

Stay Smart and Stay Diversified. For more information on understanding crypto and the economy you can go to www.DiverseInvesting.com or purchase The Road Map to Investing on Amazon.

Author: J. W. Sabastian

DISCLAIMER

Company does not give legal, tax, investment, or economic advice. Each Applicant should consult with his or her own legal, accounting, or investment advisor regarding matters of real estate and other investments and financial and economic matters.

At times, Company may allow products, services, and investment opportunities (“Opportunities”) to be presented to Applicant and other participants attending Company sponsored programs. Company does not endorse and makes no representations or warranties regarding any Opportunities that might be presented. Applicant and other participants should complete their own due diligence and seek advice from legal, financial, accounting, or other professionals prior to entering into any arrangement regarding the Opportunities.

Company allows outside vendors to sponsor events. Sometimes, these sponsors pay a fee to exhibit their items and services at Company programs and events. Company does not investigate or make any representations regarding the sponsors or their services including, but not limited to their quality, reliability, or integrity. Likewise, Company does not investigate its applicants or program participants. Company assumes no responsibility for any act or omission of its applicants, sponsors, or program participants.