Last year has been a crazy year with the ups and down of the stock market due to the pandemic and closing of the world’s economies.

Before the pandemic, with the economy already in a deflationary decline with the dollar collapsing, commodities on the downturn and oil going into negative territory our economy was struggling to pull itself back out of a small recession.

Then the fear of the COVD-19 virus spread globally around the world reaching the United States which caused a complete shutdown of the marketplace and the economy which created the largest government stimulus or monetary program since World War II.

The U.S. economy before March was already in a decline towards a recession which caused the Federal Reserve and Treasury to do something that they never did since World War II which was to merge the Federal Reserve and the Treasury together to manipulate the money supply. With its merger the government created a process to provide a larger money supply to reach what we call the broad economy. The Federal Reserve stepped in and created $1 trillion in brand new bank reserves out of thin air to buy $1 trillion in Treasuries over a 3-week period. Without this merger the Federal Reserve can only control the commercial bank reserves, currency in circulation, and treasury general account. Meaning that the Federal reserves can only stimulate the economy by providing loans through the central banks to the general public. Today with the merger, not only is the Federal Reserve providing loans for the central banks but also buying back the Treasury notes offered up by the Treasury. With this process, the Federal Reserve and the Treasury can manipulate the short-term and long-term treasury notes which controls the outcome of the interest rate and the movement in the stock market and inflation.

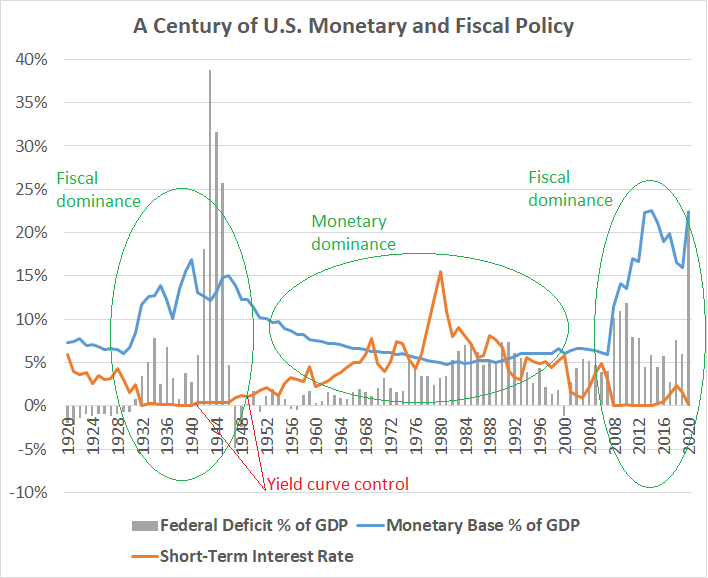

The chart below shows how the Federal Reserve and Treasury are working together like the 1940’s to solve a similar financial crisis.

During this merger, the government also created one of the largest programs called the Cares Act (2.2 Trillion Dollars) purposely pushed out to the economy to get the economy back to some kind of normalization. This package helps small businesses, fund schools, fund unemployment, give aid to the health care system, and other programs to try to create inflation in the marketplace. The government has just passed another Relief bill 1.9 Trillion.

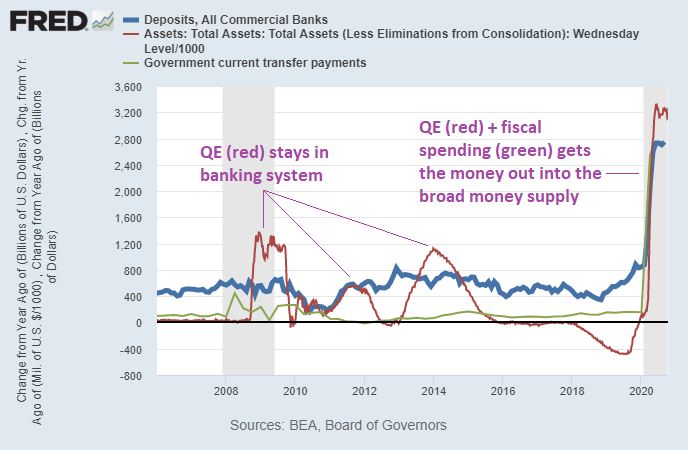

The chart below is a good example of what is going on with the Federal Reserve, Treasury, and Government Quarantine Easing programs which is affecting the broad money supply.

Look how much bigger the spending gets compared to the 2008 crisis.

However, the question is, can the Federal Reserve control the interest rate like the 1940s’.

Time will only tell.

So, what is the biggest factor that will affect the stock market in 2021?

After viewing, acquiring, and researching this topic, the answer I came up with, is that the long-term treasury notes will affect the stock market in 2021.

Knowing that the Federal government is not going to raise the interest rates, the underline treasury note will be the catalyst that will determine the stock market direction.

If the Federal Reserve cannot control the long-term treasury note by buying them back then the stock market will correct due to increasing interest rates which will give investors other options to put their money into different financial vehicles. For example, the long-term treasury note.

At the current time, the Federal Reserve and the Treasury are controlling the short-term and long- term Treasury notes by buying or not buying the notes to regulate an inflationary adjustment above a 2.0 percent Gross Domestic Product.

If other countries do not step in to acquire these treasury notes, then the Federal Reserve will need to purchase them, illustrated in the chart below.

As you can see in the chart below, the yield curve is steepening, this means that the difference in rates between the long end of the Treasury curve and the short end of the Treasury curve is widening, which will cause concern to the marketplace.

However, it is much harder to control the long-term Treasury note. If the long-term note starts to rise then the stock market will start to react. In this chart one can see that the 30-year bond treasury yield is starting to move higher.

Source came from Macrotrends: 30 Year Treasury Rate – 39 Year Historical Chart

On the 30-year-bond- treasury- yield chart above, if you take a close look at 2020 it seems that the note is starting to turn up.

To find this information on any treasury notes go to the US Department of Treasury.

If you look at the daily treasury long term rates from January to now you will see that they are increasing slowly. On January 4, 2021, the rate was 1.46 and in March 5.2021 the rate was 2.81.

This is exactly what the government is trying to create, inflation.

However, if the rate does get out of control and the government loses the ability to manipulate the long-term treasury note then at what point will the investors start to look at getting out of the stock market and look to get into a higher treasury note above the S&P dividends. At what point do investors worry about higher bond yields, such as when the 10-year treasury bill starts to rival the dividend yield on the S&P 500 in the stock market. The answer is when the long-term treasury note exceeds above 2,5 to 3,0 percent or higher.

Most likely, with this current environment gold, commodities, value stocks and overseas emerging markets will perform well until the stock market reacts to the increasing long-term treasuries. Bank stocks might do ok and growth stocks could be a mix bag.

For another source on the topic please go to the video Bonds Break Down by Lynette Zang

Stay Smart and Stay Diversified.

For more information on understanding equities and the economy you can go to www.DiverseInvesting.com or purchase The Road Map to Investing on Amazon.

Author: J. W. Sabastian

DISCLAIMER

Company does not give legal, tax, investment, or economic advice. Each Applicant should consult with his or her own legal, accounting, or investment advisor regarding matters of real estate and other investments and financial and economic matters.

At times, Company may allow products, services, and investment opportunities (“Opportunities”) to be presented to Applicant and other participants attending Company sponsored programs. Company does not endorse and makes no representations or warranties regarding any Opportunities that might be presented. Applicant and other participants should complete their own due diligence and seek advice from legal, financial, accounting, or other professionals prior to entering into any arrangement regarding the Opportunities.

Company allows outside vendors to sponsor events. Sometimes, these sponsors pay a fee to exhibit their items and services at Company programs and events. Company does not investigate or make any representations regarding the sponsors or their services including, but not limited to their quality, reliability, or integrity. Likewise, Company does not investigate its applicants or program participants. Company assumes no responsibility for any act or omission of its applicants, sponsors, or program participants.