My dear friend’s grandmother, Florence was a globe trotter of the highest order, even while crippled and walking with two canes, she found ways to travel to foreign countries and always had a good time while learning about a new culture and making friends.

After the fall of Red China, Florence got on the phone to her favorite travel agent and booked not one but two tours of the place where eggroll was certain to be deep fried and plenty of duck sauce.

The first trip was to the mainland of China where Florence collected currency as a totem to a regime that no longer existed. The face of the deposed “Chairman Mao” blazoned each yuan[1]that Florence lovingly placed them in binders encased in plastic as a part of a globetrotter’s currency collection. Woe, her grandchild drew a mustache on Mao as they had on Castro after her visit to Cuba!

The second visit encompassed iconic places in China, including the Great Wall which one had to climb up a gazillion steps and then walk to the end, based on the section of the wall you began hiking from. As a part of Florence’s tour, she insisted on being carried up, instead of walking the wall with two canes. Finally reaching her tour group at the end, she was met with a cake and champagne to celebrate her persistence.

Since Florence’s experiences in China over the last forty years, China has grown into the globe economic and technical country with influence on the globe markets, including having stocks in the U.S. stock exchange.

In our last newsletter Which Way Will the Market Move for 2021, we talked about how treasury bills and the pandemic are affecting the markets and whether our country will move into hyperinflation or deflation over the next few years.

Just a couple of months later, however, we are changing our predictions on emerging markets in China, due to the delta variant and the changes in China’s regulations pertaining to its overseas listing system for domestic enterprises”, which will tighten restrictions on cross-border data flows and security.

In the last few years, Chinese companies have become especially persistent in their wanting to list on the NYSE, regardless of trade sanctions and tensions between the U.S. and China. In 2020 alone there were more China based IPOS hosted in the US that raised the most capital since 2014[2] while 60 or so more intend to go public in 2021 in the US market.[3]

However, today, the Chinese government has been cracking down on stocks that trade on the US exchanges. This is due too several factors as noted by Peter Berezin of BCA Research[4]

“U.S. investors will have to weigh the risks of owning ADRs (American Depository Receipts) at a time when tensions between Beijing and Washington remain elevated while all global investors will have to balance the allure of China’s vast addressable market with the possibility that officials may reshape company prospects at the stroke of a pen via the imposition of regulatory strictures.”

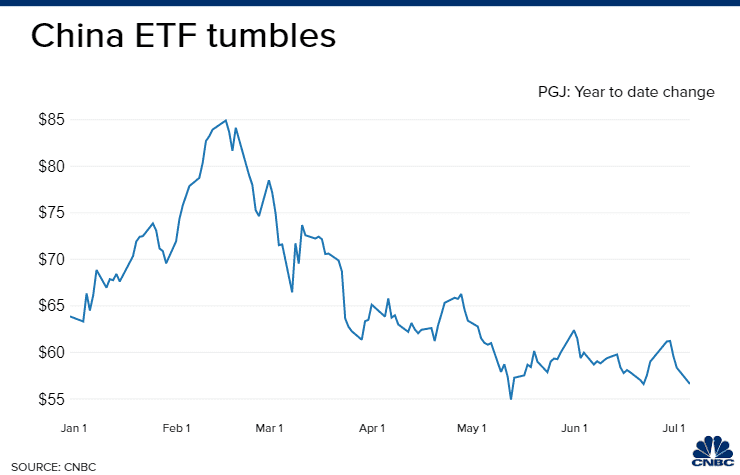

The U.S.-China Economic and Security Review Commission states that there are a total of 248 Chinese companies listed on all three major US exchanges. Total capitalization of $2.1 trillion. There are also 8 state Chinese state (nationally) owned enterprises listed on US markets.[5]Since February 2021 companies listed on the Invesco Golden Dragon China ETF (PGJ), which tracks U.S.-listed Chinese shares of ADRs[6]have lost a third of their value.

[2]www.rencap.com/

[3] China is cracking down on stocks that trade on U.S. exchanges. Here is what it means if you hold them (msn.com)

[4] ibid

[5]https://www.uscc.gov

[6] American depository receipts allow Americans to invest in foreign markets.

Bloomberg reported that Chinese regulators are “eyeing a rule change that would allow them to block a domestic company from listing in the U.S. even if the unit selling shares is incorporated outside China, creating a schism in how many Chinese companies may be allowed to list on the NYSE.

Also, when an investor buys a stock on the Nasdaq or New York stock exchange, the investor thinks that they are buying a share of the company. This is not always correct when buying a Chinese company. “That’s because Chinese companies use a structure called a variable interest entity, or VIE, to raise money from foreign Investors.

“What’s a VIE? The structure uses two entities. The first is a shell company based somewhere outside China, usually the Cayman Islands. The second is a Chinese company that holds the licenses needed to do business in the country. The two entities are connected via a series of contracts.When foreign investors buy shares in a company that uses a VIE, they’re purchasing stock in the foreign shell company — not the business in China.For example, when US investors buy shares in Chinese ride hailing giant Didi, which went public in June on the New York Stock Exchange, what they’re doing is buying stock in a Cayman Islands firm called Didi Global. Didi Global doesn’t own the business in China that connects riders to drivers. But it does have contracts in place that entitle its shareholders to the economic benefits produced by that business. This can become huge risks because it is not clear if the contracts are enforceable under VIE’s and Chinese law.

“Why use a VIE? Chinese firms have been using the structure for decades because foreign investors are not really allowed to own stakes in local firms in industries including tech. Still, Chinese companies want to raise money abroad. Creating an offshore holding company that goes public helps Chinese companies get around those rules. Wall Street and US regulators have long accepted this arrangement, which gives American investors easy exposure to dynamic companies that are powering the world’s second largest economy.We have been further advised by our PRC legal counsel that there are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations,” Didi cautioned. “The PRC government may ultimately take a view contrary to the opinion of our PRC legal counsel.”

For more information go to BeforeThe Bell byCharles Riley[1]

Other major factors that can affect the emerging market is still the growing concern and increase cases of corona virus. Especially in the new strain called the Delta strain which is 225% more contagious then the Alpha strain.

Australia just went on a lockdown, and it seems that Europe might follow.

In Israel they are concerned because several people that took the Pfizer vaccine are still getting infected.

However, the UK has just announced that their country is moving to a no mask mandate policy.

The question is, will the continuing spread of the virus continue to hamper or slow the economic growth around the globe? My answer is yes.

Hospitals are still being overrun by patients and some people are once again afraid to go outdoors. Most individuals feel more comfortable just staying at home instead of taking a chance to going anywhere.With this cascade effect, the economy will slow for sure. Without money being exchanged through the economy, things are going to slow down, which could lead into a more deflationary environment for both Europe and the U.S.

Risks for Investors

The risk to investors is that one should watch the ADR markets carefully if they are vested in Chinese companies. Typically, the founding executives retain a large controlling stake of the U.S.-listed Chinese companies, thereby affording themselves a “way out of dodge” if the markets tumble or if their company is unlisted due to government restrictions and regulations.

What might be safer is to transfer these holdings into companies that are established rather than IPOS as a means of maintaining one’s position in Chinese market. Matthews Asia positions Artificial Intelligence for example as a viable investment.[2] For now, investors should be cautious. Cash out or restructure if you are uncertain about the state of these investments.

[1]BeforeThe Bell by Charles Riley • Sunday, August 8

[2]Asia – Riding a Wave of Innovation | Investing | Matthews Asia

Stay Smart and Stay Diversified. For more information on understanding equities and the economy you can go to www.DiverseInvesting.com or purchase The Road Map to Investing on Amazon.

Author: J. W. Sabastian

DISCLAIMER

Company does not give legal, tax, investment, or economic advice. Each Applicant should consult with his or her own legal, accounting, or investment advisor regarding matters of real estate and other investments and financial and economic matters.

At times, Company may allow products, services, and investment opportunities (“Opportunities”) to be presented to Applicant and other participants attending Company sponsored programs. Company does not endorse and makes no representations or warranties regarding any Opportunities that might be presented. Applicant and other participants should complete their own due diligence and seek advice from legal, financial, accounting, or other professionals prior to entering into any arrangement regarding the Opportunities.

Company allows outside vendors to sponsor events. Sometimes, these sponsors pay a fee to exhibit their items and services at Company programs and events. Company does not investigate or make any representations regarding the sponsors or their services including, but not limited to their quality, reliability, or integrity. Likewise, Company does not investigate its applicants or program participants. Company assumes no responsibility for any act or omission of its applicants, sponsors, or program participants.