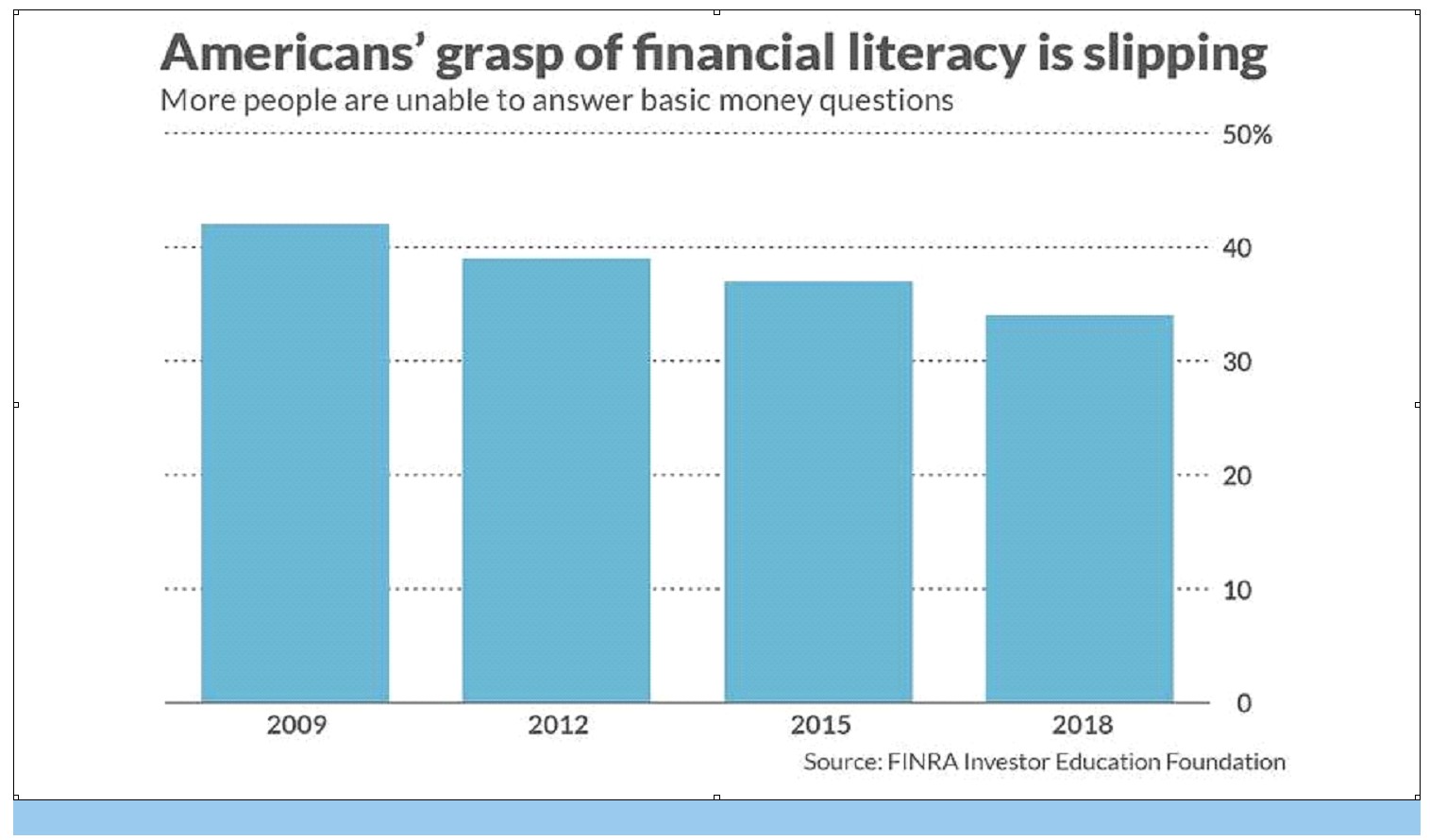

MSN Money states that “Between 2009 and 2018, there was an 8% slip in the amount of people who could correctly answer most questions about interest rates, inflation, bond prices, financial risk and mortgage rates — from 42% to 34%.”

Where are you within this graph?

Here at Diverse Investing we are doing everything we can to help educated and strengthen the investor knowledge in all aspects of wealth management. In this article we want to discuss the mistake people make when choosing a financial advisor. What fee structures that financial advisor operates under. And some websites that will guild you in the right direction in choosing a financial advisor.

So, what are some of the mistakes that people make when choosing a financial advisor. Some critics say one mistake is, sometimes choosing a financial advisor that your friend recommended. However, this is not always the case. If that advisors specializes in the area you are looking for and knows how to create a well strategize plan, this is not necessarily always a problem. However, not knowing how a financial advisor gets paid and operates is big problem. Financial advisor operates in two ways, they are comprehensive financial planners or asset management planners. They get paid in many ways. The most common are commission based, fee-based, fee-only, and hourly. Whatever financial advisor you choose please make sure they are certified and fiduciary qualified. The meaning of fiduciary is an individual who is ethically bound to act in another person best interest.

There are several licenses and certifications an advisor can have: CFP, CFA, CPA, and ChFC. The CFP (Certified Financial Planner) is generally considered the gold standard in the industry. Advisors must have several years of experience, take an extensive course and pass a six-hour exam to become a CFP. The worse thing to do, is pick the first financial advisor that you meet with out shopping around. Here is a two website that Diverse Investing recommends when looking for a qualified financial advisor. www.smartasset.com and www.napfa.org.

DISCLAIMER

Company does not give legal, tax, investment, or economic advice. Each Applicant should consult with his or her own legal, accounting, or investment advisor regarding matters of real estate and other investments and financial and economic matters.

At times, Company may allow products, services, and investment opportunities (“Opportunities”) to be presented to Applicant and other participants attending Company sponsored programs. Company does not endorse and makes no representations or warranties regarding any Opportunities that might be presented. Applicant and other participants should complete their own due diligence and seek advice from legal, financial, accounting or other professionals prior to entering any arrangement regarding the Opportunities.

Company allows outside vendors to sponsor events. Sometimes, these sponsors pay a fee to exhibit their items and services at Company programs and events. Company does not investigate or make any representations regarding the sponsors or their services including, but not limited to their quality, reliability, or integrity. Likewise, Company does not investigate its applicants or program participants. Company assumes no responsibility for any act or omission of its applicants, sponsors or program participants